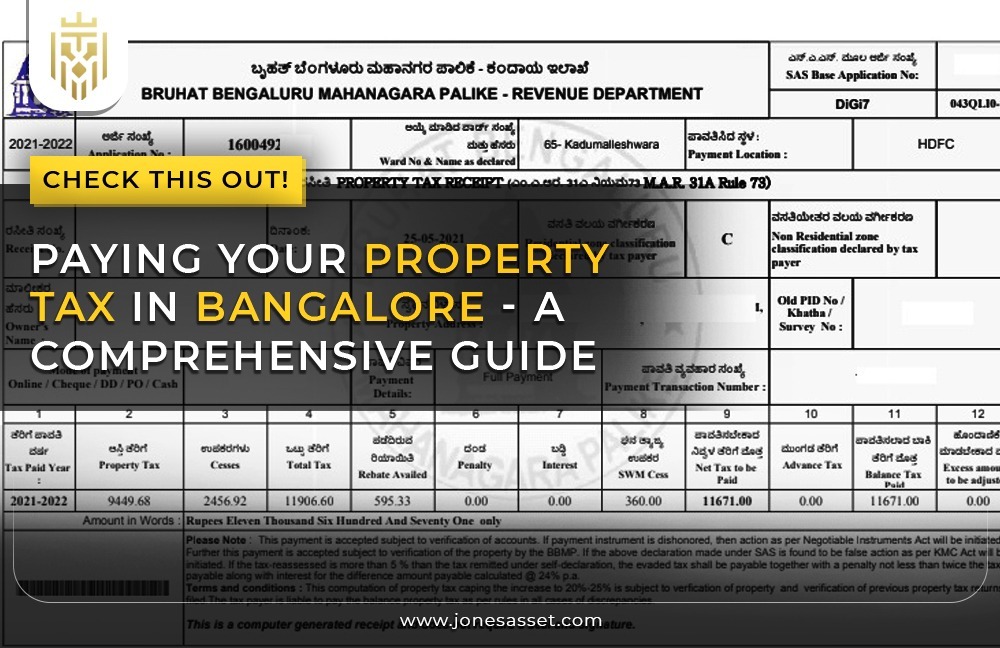

Paying Your Property Tax in Bangalore:

The steps to be followed for paying property tax in Bangalore are: First, access the official BBMP website, second; select the property tax tab, third; procurement of relevant documents such as Khata certificate and PID, last; do the online payment of property tax.

Understanding Property Tax in Bangalore:

Property tax in the city of Bangalore is revenue raised by the BBMP through a statutory assessment of the property owners. The amount of cost which is charged depends on the size of the property, location, and type of the property. The tax helps finance civil conveniences and infrastructural facilities within the city area.

What is Property Tax?

It is a type of taxation that is direct and paid by the owner of property that is assessed by local governments. It is relative to the worth of the property and is collected for financing public amenities such as maintenance of the roads, provision of water and sanitation, expenditure on education, and many more.

Role of BBMP in Property Tax Collection:

The BBMP has a direct mandate in the collection of property tax in Bangalore, it stands for Bruhat Bengaluru Mahanagara Palike. It appraises the value, determines the amount, and sends out the bill for collection for funding urban infrastructures as well as services.

Gathering Necessary Documents:

Documents are necessary as they act as written proof of the tax payments done by the property owner. We shall go through some of the necessary paperwork to be present during the payment of property tax.

Essential Documents for Online Tax Payment:

Documents required for property tax payment in Bangalore are a khata certificate, a tax receipt of the immediately preceding year, and a property identification number. These are required in order to accurately evaluate and compensate a patient.

Khata Certificate:

Khata Certificate:

A Khata certificate is a legal document that contains details related to that particular property as the size of the property, the geographical location of the property, and the taxable value of the same. This is legally used as a mode of conveyancing for property transactions and for tax purposes in Bangalore.

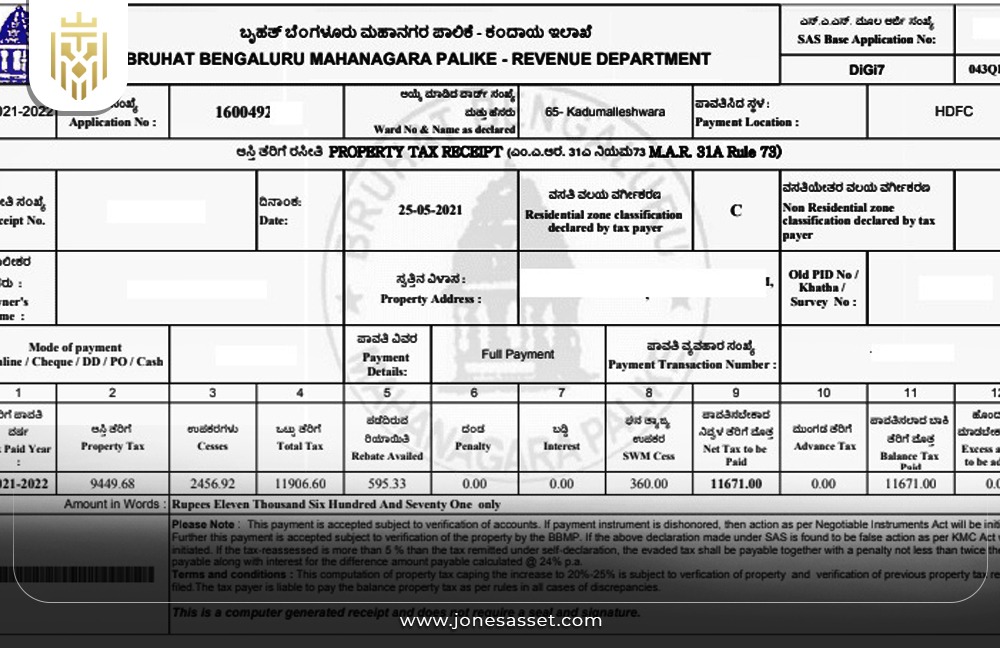

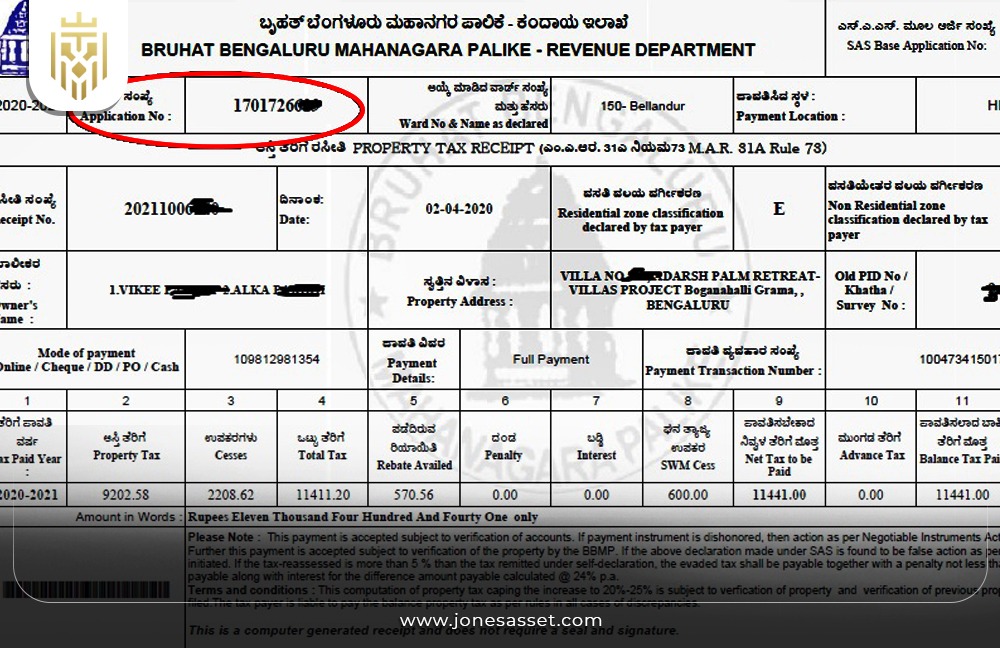

Previous Year’s Property Tax Receipt:

One of the prerequisites for electronic property tax payment is a receipt from the previous year’s property taxes collected by the Bangalore government. This section seeks to capture the summary of the previous year’s tax payment which may be needed for comparison or auditing.

Property Identification Number (PID):

The PID is a unique number given to every property within the BBMP and contains information related to the physical and geographical location of the property. It is highly important for the assessment and requirement of property tax charges in Bangalore to aid in proper billing and documentation.

Initiating Online Payment Process:

You can start paying the online property tax in Bangalore by visiting the official site of BBMP and clicking on the option of property tax then you need to submit the details regarding the property and the amount of tax to be paid then follow the process of online payment.

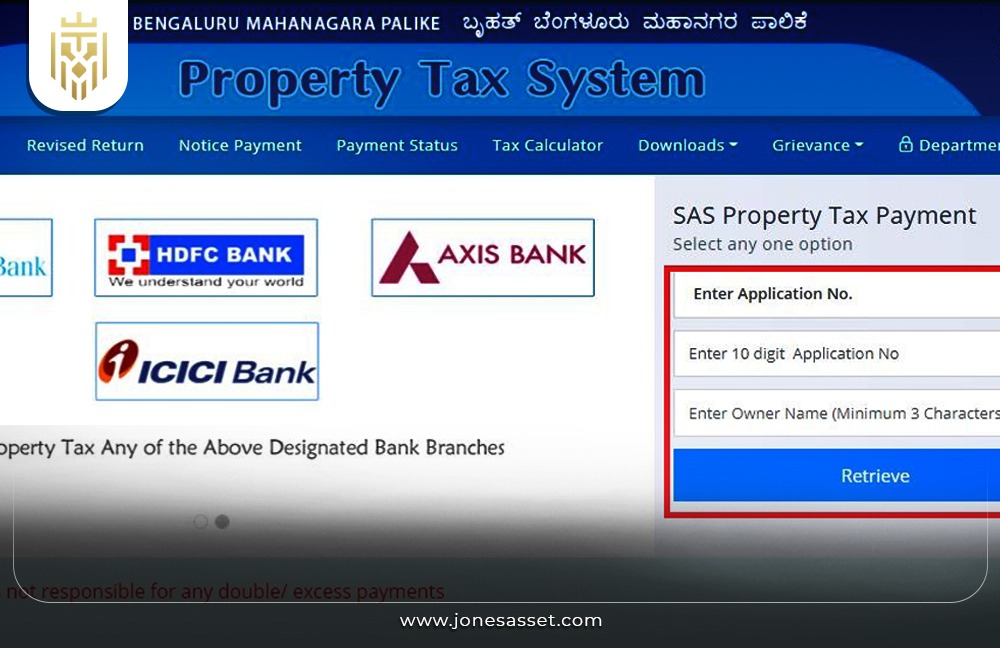

Visiting the BBMP Website:

The official BBMP web page is where one can make their property tax payment online, and read other details related to tax and any changes to procedures and requirements.

Selecting the Property Tax Option:

When on the official BBMP website, users are required the click on the link especially provided for the property tax. Or, commonly this option is located under the “Services” or “Online Services” menu. Select the property tax option to get directed to the site for the payment of tax and every other service that has to do with these taxes.

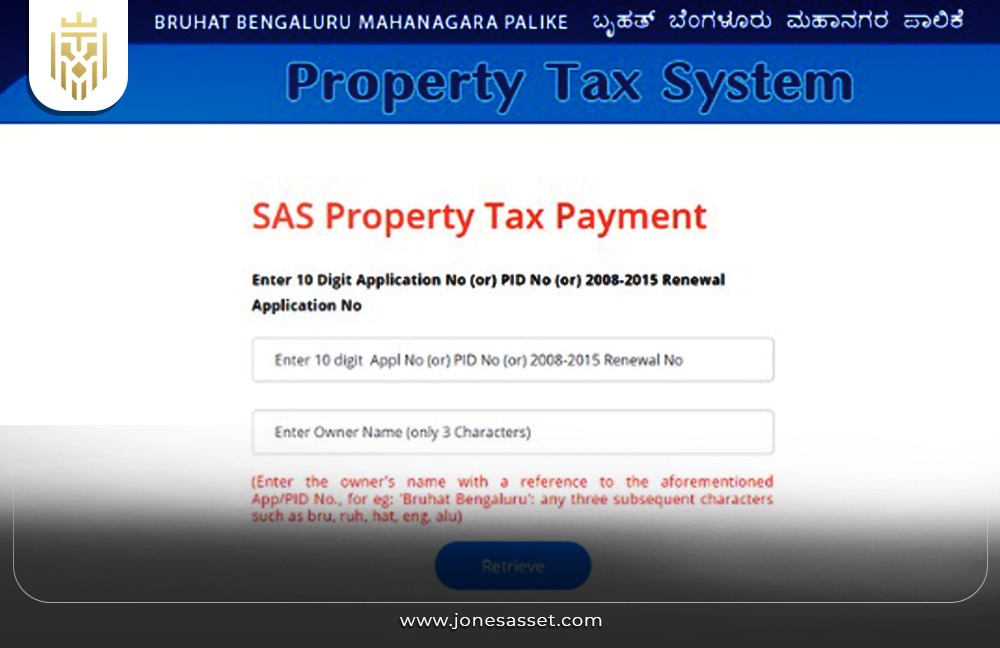

Entering Property Details:

A property tax portal means that there are a number of details about the property you own that will be required from you. This most widely comprises information like the address of the property, the owner of the property, the type of the property, and its size. Some of the details to be entered include; It is advisable to input these details accurately to avoid stray values affecting the tax assessment.

Providing Property Information:

Provide all necessary property details as mentioned on the BBMP website and fill in all the relevant details carefully. This can involve aspects like usage, that is, whether the property is for residential, industrial, or separate utilizations, built-up area, and any exemptions or concessions that may be relevant.

Verifying Details on the Website:

This precaution should be taken before making the payment to check all the given details on the BBMP website. It is equally important to double-check such information to avoid making mistakes when performing a tax assessment or payment.

Selecting Payment Method:

It offers customers the convenience of paying through either debit or credit card, or through the use of online banking, all of which can be found on the BBMP website. The major cashier solutions include bank transfers, credit/debit cards, and payment platforms such as wallet solutions.

Choosing Payment Options:

Once you are determined with the mode of payment that you wish to use, go to the payment methods page. Here, you may be offered options like full payment, installments if available, any discounted prices that you are qualified for, or rebates you would like to pay for.

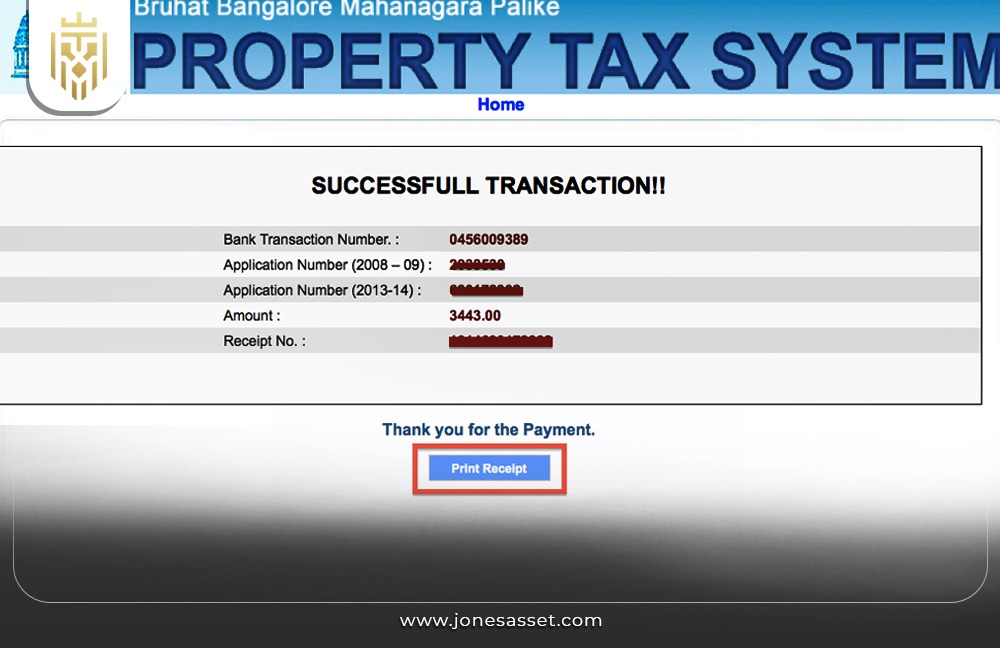

Completing the Transaction:

By following the transaction instructions provided on the BBMP website, the transaction is securely processed. Within the context of payments, this can include, for example, entering credit card details, confirming details of the transaction, and the amount to be paid before confirming the transaction.

Downloading Payment Receipt:

Once you successfully go through the payment process, it opens a downloading space where you are able to access the payment receipt in case you need it in the future. This receipt confirms the transaction completed and is useful in providing further information about the completion of the transaction in case of issuing receipts for the financial records.

Generating Receipt After Successful Payment:

This payment is intended to be processed after 24 hours of the BBMP SWM management plan approval, and on successful payment, the BBMP website will automatically produce the payment receipt. This receipt is proof of payment and contains information such as the 4-digit transaction ID; payment amount; date and time of payment.

Saving Receipt for Future Reference:

Before proceeding to the next step, it is advisable to have a copy of the payment receipt saved for purposes of future reference. You may require it for assessments or tax compliance, legal documents affecting the property, or in response to any questions or disputes arising from the payment transaction.

Exploring BBMP Property Tax Forms:

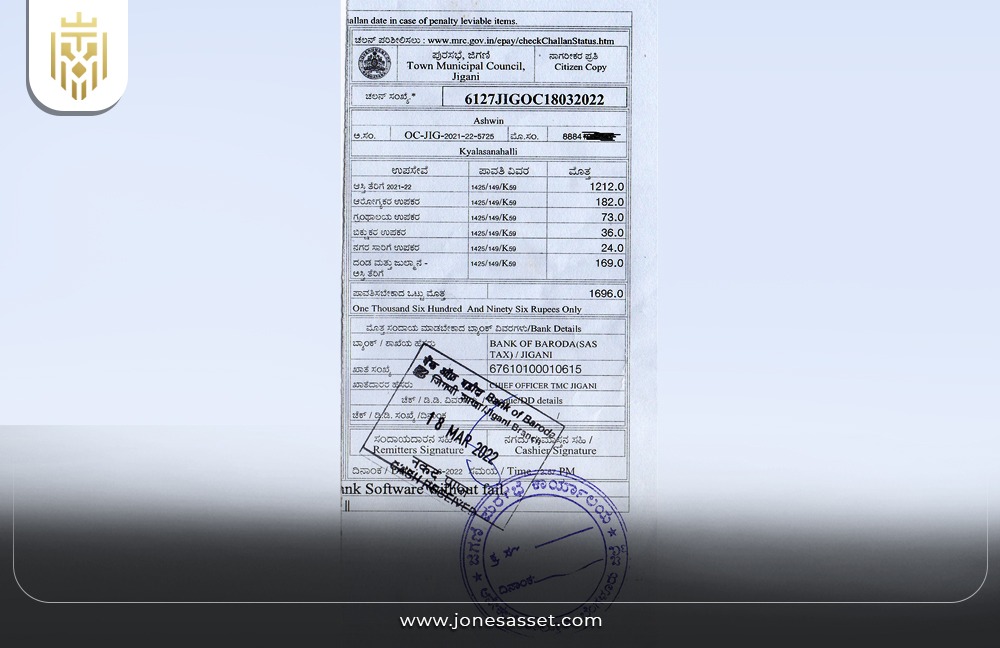

Paying tax varies for each type of property, as they serve different purposes. We shall go through the forms required:

Understanding Different Forms for Property Tax Payment:

According to the situation, or the type of property under consideration, BBMP has several forms for making the payment of property taxes. These forms assist in grouping the property based on the identification numbers and the changes that may exist regarding the property thus assisting in assessing taxes and records.

Form 1: PID Number:

That convention is employed on Form 1 whenever the property possesses a Property Identification Number (PID). This form is particularly applicable to the extent that the property has been provided a distinct PID by the BBMP and hence enables identification of the property alongside the assessment made for taxation.

Form 2: Khata Number:

Form 2 should be used where the property has been assigned a Khata number or any reference number but has not been issued a PID. The Khat number plays a significant role in the practical function of ownership and legal uniqueness of the particular territory within Bangalore.

Form 3: Absence of PID and Khata Numbers:

The third version of the form which is the USD form 3 is applied to the properties that have no PID or Khata number. This is an interim format and is usually required in cases when properties are under development or are awaiting formation documents from BBMP.

Form 4: No Changes to Property Details:

Form 4 is also used in the situation when no changes have taken place from the previous assessment year in regard to the details given in the property. This is helpful to prevent confusion and discussions regarding tax payments as it makes it clear that the value of the property and its features has not changed.

Form 5: Changes in Property Details:

Section 5 is also used where there exist alterations in the physical features of the property, extension or conversion of use, and change of ownership. This form enables BBMP to obtain the latest information to use in fixing taxes as a way of encouraging property owners to pay taxes regularly.

Form 6: Exemption from Taxes:

Form 6 is used for properties that would be required to pay less taxes, such as religious organizations or charitable ones. This form needs to be filled and sent to make a request for the exemption and do not allow unnecessary tax impositions.

Understanding Property Tax Timeline:

There are fixed dates for the commencement and deadline of paying one’s property tax in Bangalore, and not paying them on time leads to severe consequences. The following information can serve as a reminder to pay one’s taxes on time:

Commencement and Duration of BBMP Property Tax:

Biennially, it is common to find BBMP property tax calculation being evaluated based on the fiscal year which starts from April 1st of a specific year and ends on March 31st of the following year. It is a common policy for property owners to be taxed for the full fiscal year of the property based on its assessment rate.

Payment Deadline and Consequences of Delay:

BBMP property tax is to be paid mostly by May 30 every year without any additional charges. It is due to this that any payment made after this date attracts interest. Prompt payment prevents owners from paying extra amounts in addition to legal damages.

Availing Discounts and Interest Rates

One might find the tax amount a bit too much, and that’s quite understandable. Life’s not so easy, and with the price of everything increasing on a daily, weekly, monthly, and yearly basis, this information might help you save some money.

5% Discount for Timely Payment:

To encourage early payment of property tax, BBMP provides a 5% rebate for full payment which is normally due before the early bird deadline of April 30th each year. This incentive promotes early payments which are cheaper to make than delayed payments and generally assists property owners in the long run.

Interest Charges for Delayed Payments:

In case of delay in making the payments, the BBMP has the authority to levy an interest of 2% per month on the tax amount that is due. This penalty implies that timely payment should be made as and when they are required to avoid incurring other charges.

FAQs:

1. How to Pay Property Tax Online in Karnataka?

In Karnataka, to pay property tax online, the following steps need to be taken: Go to BBMP’s official website and select the property tax tab, enter the PID number or the Khata number of the property, check the tax amount, and then make the payment through the internet using any online mode of payment.

2. What is the PID Number in Property Tax Bangalore?

BBMP assigns a PID (Property Identification Number) for every property to distinguish it from other properties. It assists in simplifying the process of tracking properties, and their value for tax purposes and record keeping.

3. How to Check BBMP Tax Paid Details?

To verify details of taxes paid to BBMP please log in to the BBMP property tax site and type in the PID or Khata number to get the details on the BBMP tax paid and the history of the payments made in the past and outstanding amount or balance tax dues.

4. How to Download the BBMP Property Tax Receipt?

To print out the BBMP property tax receipt, one has to first, log onto the BBMP property tax official site, then fill in the property particulars, go to the payment history tab, and download the receipt of the specific financial year.

5. How to Find the 10-digit Application Number for BBMP Property Tax?

The 10-digit application number for BBMP property tax is available on the previous tax receipts or from your property details using PID or Khata no after logging into the BBMP property tax online portal.